Post-Brexit Britain Has a Lack of Asian Trade Agreements, but There Are Opportunities in ASEAN and China for British Investors

A review of pending and on-going trade agreements as identified by the UK Government reveals a huge lack of trade attention with Asia. This ought to start alarm bells ringing – Asia is expected to produce 50% of global GDP in the next 20 years, and represents huge opportunities for British companies to both sell products to these markets, manufacture, and trade.

As McKinsey succinctly put it in this recent report: “Asian flows and networks are defining the next phase of globalization.”

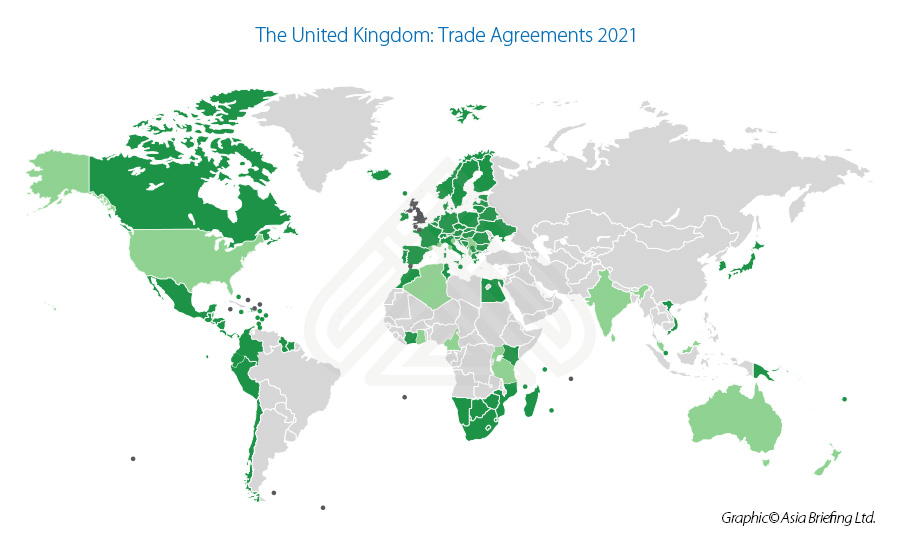

Instead, what we can see is that the UK has been primarily reliant on existing, well-established trade networks in primarily the rump of the Commonwealth of Nations in Africa, the Caribbean, and the European Union to beef up trade. Little attempt appears to have been made to cement new ties in Asia, with Vietnam the only recent regional trade deal made with a country that has not previously been part of the Commonwealth.

We can contrast the UK position and compare that with China’s Belt & Road Initiative reach. Although this is not entirely like-for-like, as the Belt and Road is a loose, partially informal grouping of nations, with not all possessing trade agreements with China, it does echo in part the status of Britain’s Commonwealth of Nations. I have previously pondered the question What Would China Do If Beijing, Not London Managed The Commonwealth?

Some countries, including some of the EU member states have both a deal with the UK through the European Union, and have also signed off a BRI MoU with China. What this map below really states is how extensive the China trade reach is, and how British businesses would be foolish not to seek to be part of that network through investing in China in particular, despite political differences of opinion.

While the UK has made inroads into Trade blocs such as Cariforum, the trade volumes are small, in just a few millions of dollars. Better, but still not high volume are trade deals with the two African blocs the UK has made agreements with SACUM (Botswana, Eswatini, Lesotho, Namibia, South Africa, Mozambique) and ESA (Mauritius, Seychelles, Zimbabwe). In any event these were previous EU agreements that have been re-positioned for Brexit UK, there is nothing especially new about them.

A current map of the UK’s trade agreements in effect can be seen as follows:

As can be seen, there is a huge hole over Asia. Important markets that are missing from the UK trade perspective are as follows:

ASEAN

ASEAN is a ten-state free trade bloc that includes Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam. Of these, the UK has signed off trade agreements with Singapore and Vietnam while Brunei, Malaysia and Singapore are all members of the Commonwealth.

ASEAN’s collective GDP in 2019 was about US$9.34 trillion, roughly equivalent to that of the entire Commonwealth and three times larger than that of the UK itself. ASEAN is a market of about 135 million middle class consumers (24% of the total population) and is expected to double in size in the next decade. It is one of the global trade development drivers, yet the UK’s engagement with it is minimal.

ASEAN nations meanwhile, apart from enjoying Free Trade amongst themselves, also have Free Trade Agreements in place with China, India, Australia, New Zealand, Japan, and South Korea.

While Singapore is a wealthy market and a prime position for UK financial services and products, acting as the de facto financial capital for ASEAN, the Vietnam market essentially provides opportunities for British companies who may wish to have an alternative to China, and especially in export manufacturing to service China itself, India, the other ASEAN nations and the EU. Vietnam signed off an Agreement with the European Union which came into effect from August 1 last year.

Our complimentary 2021 Doing Business Guides to the region can be found for ASEAN here and Vietnam specifically here.

China

The UK has political difficulties with Beijing at present, concerning both Hong Kong and the treatment of Uighurs. The first is an issue concerning the practical longevity of the ‘One Country, Two Systems’ concept, which has run effectively for 22 years but is now running out of steam, and the rule of law and extradition from Hong Kong to China. Beijing has handled this poorly however the basic premise is true: Hong Kong is part of China. Having no extradition treaty between Hong Kong and China would turn the territory into a haven for the triads and criminals. The territory has never been democratic and wasn’t under British rule either. Calls for democracy in Hong Kong are themselves unrealistic and not grounded in its history.

Concerning the Uighurs, China is justifiably concerned about the spectre of Islamic Fundamentalism in Xinjiang, which shares borders with Afghanistan and Pakistan. The weakness here is religion, and the subverting of Chinese citizens through fundamentalist Mullahs from across the border. This is a real threat, and China again is ensuring this does not result in serious trouble. While there are specific accounts of individuals being victimised, the Xinjiang scenario must consider the greater good for the population. It is a region I have travelled extensively in and understand the stresses. China’s imposition of security of Xinjiang needs to be understood in the context of human rights and Islamic fundamentalism rather than aimed directly at China and ignoring the extremist threat.

However setting those aside, there have been some significant recent developments in opening up the China market. In 2020, China amended its foreign investment laws, released a new foreign investment catalogue, and issued a ‘dual circulation’ strategy which effectively re-positions China’s economy from a manufacturing base to a consumer based model. These new regulatory changes and policy directions make it far easier than ever before to sell product to China. We summarized these in the article A New China For 2021. China’s middle class consumer base is about 400 million, and still expanding. It represents a consumer class bigger than the population of the United States. Accessing those and selling to China both via e-commerce and supply chains should be a priority for any export-oriented British manufacturer.

China has also recently signed off a Bilateral Investment Treaty with the European Union which has implications for UK invested companies in China, as does China’s FTA with ASEAN (see above) and the recent RCEP agreement. China’s increasingly global network of Free Trade Agreements, together with recently relaxed investment and market access for global businesses mean it should not be written off by UK investors.

Hong Kong

Neither should Hong Kong be written off, where our firm has maintained as office for nearly 30 years and are well aware of the local developments on the ground. Hong Kong is being repositioned as a financial services hub for mainland China and is being integrated into the Greater Bay Area. New financial services and cross-border access to markets in China mean that global financial firms can use Hong Kong as a base to access the US$3 trillion in personal wealth that has accumulated in mainland China. We discussed the position of Hong Kong in the articles Hong Kong, What Is Next? and A Reinvented Hong Kong Is Emerging To Become A US$3 Trillion Financial Services Wealth Management Hub.

While the UK thinks about Free Trade post Brexit, not enough attention has been paid to the opportunities in Asia, while an overly heavy-handed political approach has tainted UK-China ties. Yet there are exciting opportunities for UK companies who can be the early birds in ASEAN and obtain a balanced view of how to manage China. Our firm, with offices throughout the region, will be happy to explain how regional Free Trade Agreements, accessible by British companies on the ground in ASEAN and China can find ways to enter these markets while both selling

Comments