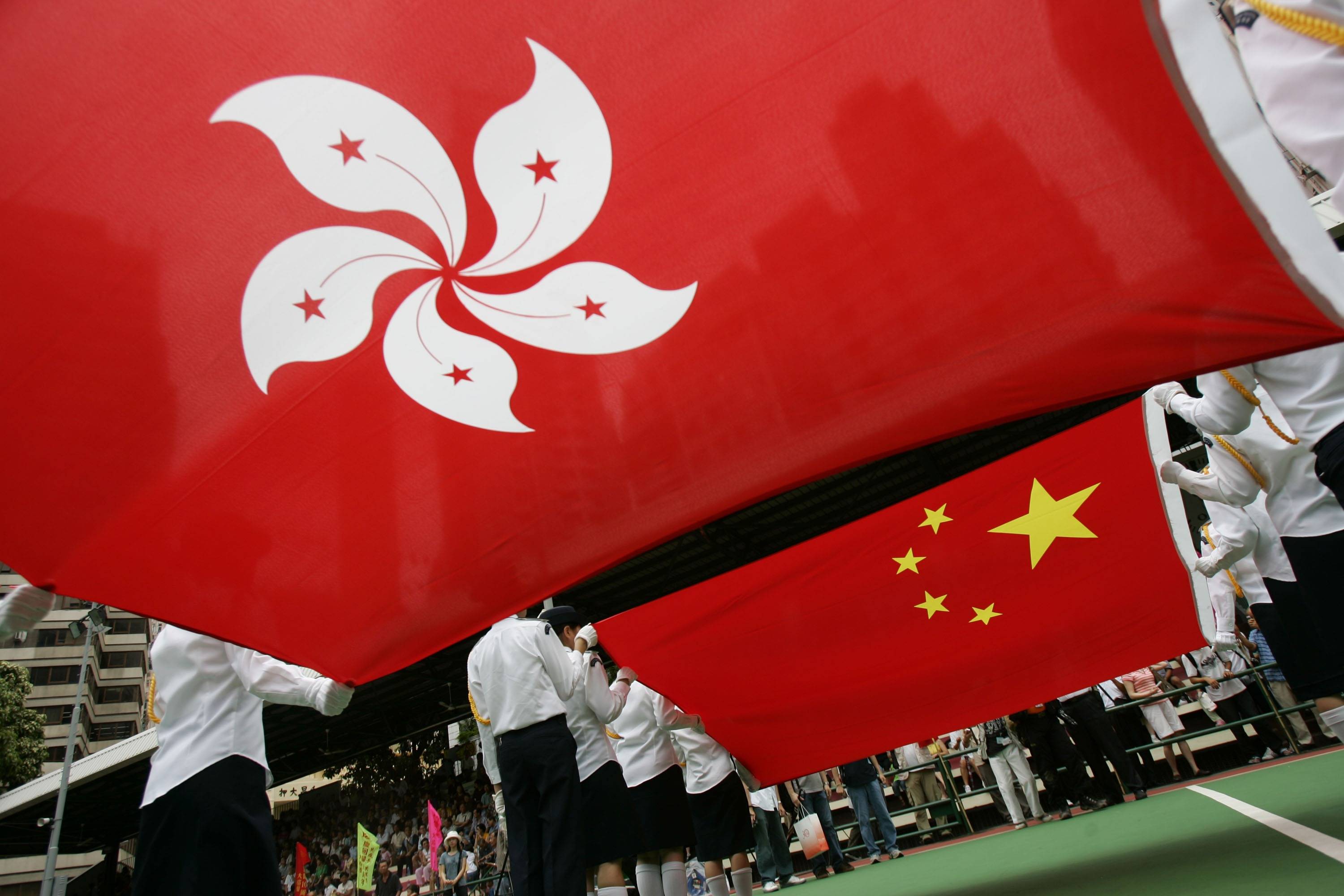

China-Hong Kong to Promote Further Liberalization under CEPA

By Yao Lu

Posted: 19th July 2012 08:43

To enhance cooperation between Hong Kong and Mainland China in the services sector, and to facilitate mutual economic development, the Chinese central government and the government of the Hong Kong Special Administrative Region signed the “Ninth Supplement to the Mainland and Hong Kong Closer Economic Partnership Arrangement (CEPA) (hereinafter referred as ‘the Ninth Supplement’)” on June 29, which is scheduled to take effect on January 1, 2013.The Ninth Supplement introduces a total of 43 service liberalization and trade facilitation measures, including 37 liberalization measures in 22 service sectors. It also enhances cooperation in the areas of finance, trade and investment facilitation. Moreover, it promotes the mutual recognition of professional qualifications in the Mainland and Hong Kong

.

One of the prominent features of the Ninth Supplement is that it actively promotes service trade liberalization between the two economies. Concretely, the Ninth Supplement further relaxes the market access conditions in 21 existing sectors, namely:

- Legal

- Accounting

- Construction

- Medical services

- Computer and related services

- Technical testing and analysis

- Personnel placement and supply services

- Printing

- Exhibition

- Other business services

- Telecommunications

- Audio-visual

- Distribution

- Environment

- Banking

- Securities

- Social services

- Tourism

- Culture

- Railway transportation

- Individual business

In addition, a new sector, education services, has also been included in the Ninth Supplement.

The Ninth Supplement specially emphasizes financial cooperation between the two sides and offers several policies to back up Hong Kong’s status as an international finance center, including:

Supporting Mainland enterprises that satisfy Hong Kong’s listing requirements to list in Hong Kong

- Actively exploring ways to lower the eligibility criteria for Hong Kong’s financial institutions when applying for qualified foreign institutional investor status

- Supporting qualified Hong Kong financial institutions to set up joint venture securities companies, fund management companies, and futures companies on the Mainland

- Exploring ways and means to deepen cooperation between the commodity futures markets in the Mainland and Hong Kong, and promoting the establishment of a futures market system in which both sides can complement each other’s advantages and develop mutually

After signing the Ninth Supplement, the liberalization measures between the two sides have reached 338 in 48 service sectors. Meanwhile, the Mainland will open 149 trade service sectors to Hong Kong, constituting 93.1 percent of all the 160 service trade sectors categorized by the World Trade Organization.

Tariff reductions under Mainland-Hong Kong CEPA, Mainland-Macau CEPA

In order to further accelerate the free flow of goods and services, speed up regional economic integration and enhance mutual benefits and common development under the framework of the CEPA, the Chinese government issued a circular which allows zero-rated tariffs to be applied to certain goods that complete the negotiation on standards for the place of origin under the Mainland and Hong Kong CEPA and the Mainland and Macau CEPA.

According to the circular, from July 1, 2012 onwards, zero-rated tariffs shall apply to 7 commodities from Hong Kong and 1 commodity from Macao that have completed the negotiation on the standards for the place of origin.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email info@dezshira.com or visit www.dezshira.com.

Comments