Blog

What is an overnight fee?

The overnight fee is also called as overnight premium. It is the interest payment that you should pay for holding the contract or stock for overnight. The overnight premium or overnight fee is applied while dealing with CFDs (Contracts For Difference). The interest calculation will be done based on the value of the contract. The interest is calculated on daily basis. if the position is held short, you will earn interest and you will be charged if you hold the long position.

Benefits of long position definition

Investors implement various kinds of strategies to minimize risk and maximize profits. If the value of the stock is about to drop, the investor will go for short position. In this process, the investor will borrow the stock from the broker and it will be sold in the market. The stock will be brought again when the stock value comes down further. And the stock will be returned to the broker. The investor will make a profit due to the drop in price of the stock.

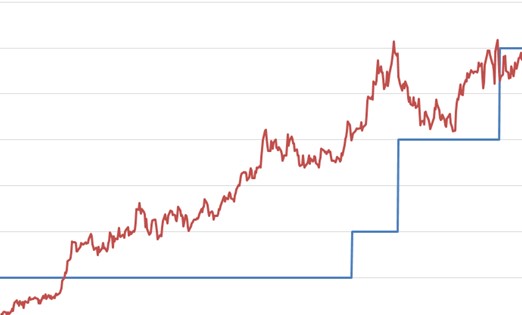

As you go through the long position definition, you will understand that the long position is opposite of the short position. Investors will buy stock with the anticipation that the stock price will increase. Most of the investors will understand that the long position will lead to profit and it is the only way of making profits. However, professionals go for long position as one of the means of profit-making options.

If you buy ‘contracts for difference’, you will pay margin money on the value of the trade. In this process, you will borrow the money from the broker. The broker will charge interest for offering the money to the client. You will get interest credit by going for short sell. However, it is a very risky procedure and you might suffer huge loss if the stock price goes in other direction.

Why overnight free?

The interest fee charged by the central bank will be low. However, the interest fee charged by broker in the form of overnight fee will be 2 to 3% higher than the bank interest rate. Hence, by managing a short position, you will earn 2 to 3% less than the reference interest rate. The broker will also charge for opening the position and closing the position. Hence, you should go for margin trading after considering all the possible plus points and minus points.

With the help of CFDs, investors will be able to take advantage of the investment opportunities. Sometimes traders can make huge gains if they are able to go for short position. The returns of long positions will be curtailed with overnight premiums. Hence, they should not be held for extended period of time.

If you have a bearish view of the market, you can go for short position. On the other hand, you can go for long position when you anticipate bullish view of the market. Investor should be aware of various features and facilities offered by the broker and they should be used cautiously to generate profits.

Comments