Blog

The Pension: A chance to live stress free!

In this world nobody gets any younger. In fact, with every passing minute everyone gets a wee bit older. When we are young we tend not to think about the future but as we get old we wish that we had started young. One of the plans that a person must think of at a young age is pension plans. Before we take a look at why one must get a pension plan, let us understand what a pension plan really is.

PENSION PLAN

If I were to describe a pension plan in a nutshell I would call it a retirement plan. Why? Simply because a pension is designed to help you survive after you retire. Most people depend on their monthly income for sustenance. They do not however realize just how dependent they are. As the years go by and you start closing in on your retirement you begin to think about the savings that you have already accumulated. If you have been smart, then you can retire in peace but if you haven’t then the stress sets in.

The global age for retirement ranges between 60 to 65 years. The sad part about today’s world is that people don’t get to retire at this age. This is largely due to lack of planning. Lack of planning translates into a lack of savings. This ultimately means that the individual has to work for a longer duration of time.

This is why people need to wake up earlier and start saving. Saving is not always easy but investing in a pension plan is. All that you need to do is find a premium that suits your need and pay it off on time. The benefits of having a pension plan in place are numerous. Let’s take a look at a few of the most pressing advantages.

A PENSION TAKES THE STRESS AWAY

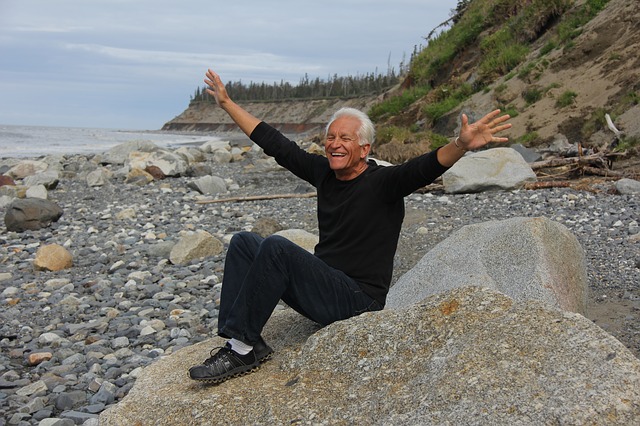

While retirement may take your salary away, your pension takes the stress away. Depending on the kind of pension plan you invested in you will begin to see returns. These returns will be paid out to you depending on the clauses stipulated in your agreement. The money that you get from the pension may not be as much as your salary but it certainly helps to reduce the deficit.

A pension also helps you do what you always wanted to do. It supports your interests and hobbies. While everyone may tell you about all the different other benefits that come with a pension plan, there is one that sticks out very prominently. That is financial independence. No one likes to be financially dependent on someone. It doesn’t matter if the dependence is on a kid or on a spouse. It just isn’t a nice feeling. A pension plan gives you financial independence long after you have retired. In fact, it helps so much that your family members will not see you as a burden!

THE PENSION CALCULATOR

Getting through the loads of options that one has at hand can be frustrating and difficult. There are numerous companies that offer pensions. Each of these companies has a multitude of schemes and options. Sifting through each of the options can be tiresome and frustrating. The best way to go about it is by calculating the amount of pension that you want to receive. There are a number of pension calculators that are available online that will help you do the job.

Once you know the amount of pension that you need you can start looking at which category of premiums the amount falls in. Bear in mind that you can’t always afford what you need. Hence it is always a good idea to go for the second best option rather than stretch yourself too thin. Thinking about the future is important but you also need to live in the present!

Many countries have a social security system and there are many which do not. What your country has to offer really does not matter because at the end of the day you need to ensure that you can look after yourself despite any kind of excruciating circumstance. A good pension plan helps you do exactly that. Don’t forget to invest as early as you can. Not only are the plans cheaper when you are younger, you will find that the returns are also better!

Comments