Blog

NetEnt – One of the World’s Leading Development Companies

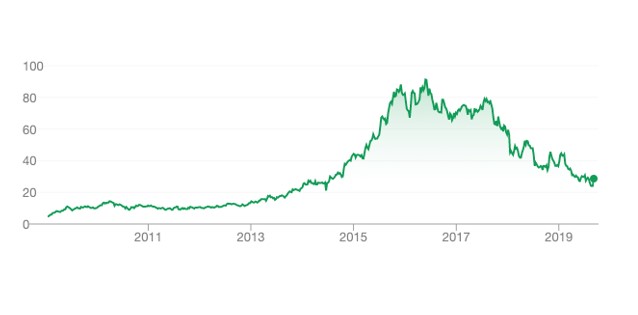

Source: Google Finance

Business: NetEnt AB (publ)

STO: NET-B

Founded in 1996, and formerly known as Net Entertainment, NetEnt has firmly established itself as one of the world’s leading development companies within the gaming sector. Since April 2007, the company has been listed on the Stockholm Stock Exchange, where their stock value has grown from 4.63 SEK to its current price of 32.60 SEK – correct at the time of writing, 10th September 2019.

Such was their success on the development front, including new customer agreements signed in 2014 with Betfair, Bwin and Rational Group – in 2018 the company started its own affiliate marketing service so that they could recommend some of the best operators licensing their software.

Being a leading provider of premium gaming solutions, as you’d expect, NetEnt supplies some of the leading operators in the country. It isn’t just the large household names that use their software, but many of the newcomers do too – Dream Vegas Casino, and Spin Station, to name but a few.

In fact, their operation is so vast that they employ over 1,000 members of staff across the globe, they have developed over 200 games, and their gaming system handled over 41.2 billion gaming transactions since they last released data on this – from 2017. Their growth and market reach are such, that hundreds of casino operators around the world license their software – many of whom are reviewed by HitCasinoBonus.com.

With an estimate market size of €11.9bn in 2018, the global online casino market is going from strength to strength. In 2018, NetEnt had an estimated global market share of circa 16%, which was greater when studying Europe alone – the business with an estimated share of 25% in this jurisdiction, according to data from H2GC.

The business saw sales growth of 8.9% last year, with a very healthy operating margin of 33.7% according to their official published financial data. They’ll be looking to increase their numeric offering of slot games available to operators, something which will only become more prevalent with the recent acquisition of casino software provider, Red Tiger. This was an all-cash deal with an initial enterprise value of £200m, with a further £23m possible in 2022, should certain agreed targets be hit.

One of the world’s most culturally diverse software providers appears to be going from strength-to-strength, and it would be surprising if the aforementioned acquisition was their last. Expect their portfolio of slots to increase, and their 16% market share to grow as they continue to innovate within the gaming space.

Comments